Your Trusted Expert for Comprehensive Tax Services

Welcome to Montgomery Tax Services, where we specialize in providing personalized and accurate tax solutions for individuals and businesses. Navigate your taxes with confidence. Our expert team provides comprehensive tax preparation, thorough tax audits, strategic tax planning, and seamless tax extensions. Let us handle the complexities, so you can focus on what matters most. With Montgomery Tax Services, your financial peace of mind is our top priority.

ABOUT US

At Montgomery Tax Services, we pride ourselves on being more than just tax professionals. We are dedicated partners committed to guiding you through every aspect of your tax journey. With years of experience and a team of certified experts, we offer a full spectrum of services including tax preparation, tax audits, tax planning, and tax extensions.

Our mission is to provide personalized, reliable, and transparent tax solutions tailored to meet your unique needs. We understand that every client's situation is different, and we approach each case with the attention and dedication it deserves.

our services

Expert Tax Preparation Services

Ensure your taxes are filed accurately and on time with our professional tax preparation services. Our experienced team meticulously handles every detail, maximizing your deductions and minimizing your liabilities. Let us take the stress out of tax season, so you can focus on what truly matters.

Comprehensive Tax Audit Support

Facing a tax audit can be daunting, but you don’t have to go through it alone. We provide thorough representation and support, ensuring you understand every step of the process. We work diligently to resolve any issues and protect your financial interests, giving you peace of mind during an otherwise stressful time.

Strategic Tax Planning Solutions

Achieve your financial goals with our strategic tax planning services. Our team of experts collaborates with you to develop personalized tax strategies that optimize your financial situation. We help you navigate the complexities of tax laws, ensuring you make informed decisions that benefit your financial future.

Hassle-Free Tax Extension Services

Need more time to file your taxes? We’ve got you covered. Our hassle-free tax extension services ensure you meet all IRS requirements, giving you the extra time you need to prepare. Trust us to handle the paperwork efficiently and accurately, so you can avoid penalties and focus on completing your tax return.

What is the Beneficial Ownership Information Report (BOIR)?

The Beneficial Ownership Information Report (BOIR) is a crucial requirement introduced under the Corporate Transparency Act (CTA) for businesses in the United States. The BOIR ensures transparency in ownership structures and plays a significant role in combating financial crimes, such as money laundering.

Key Features of the BOIR:

Mandated by FinCEN: The BOIR is regulated by the Financial Crimes Enforcement Network (FinCEN) under the U.S. Department of the Treasury.

Applicable to Most U.S. Businesses: Corporations, LLCs, and other similar entities are required to comply unless exempt.

Penalties for Non-Compliance: Failing to submit the BOIR can lead to civil penalties of up to $500 per day and additional criminal penalties.

Why file your BOIR with Montgomery Expert Tax Services?

File with confidence

Gain peace of mind with our Precise Filing Assurance and expert compliance team. We help businesses maintain good standing with government regulations and are always ready to address your questions.

Avoid mistakes & penalties

Failing to file your report accurately and on time can lead to serious civil and criminal penalties. As a trusted FinCEN BOIR filer, we ensure your submission complies with federal regulations, helping you avoid unnecessary fees and legal risks.

Get compliant quickly

Meet the federal reporting requirements for the Financial Crimes Enforcement Network (FinCEN) quickly and efficiently with our assistance— mark compliance off your to-do list quickly with confidence and peace of mind..

OUR TEAM

We take pride in our experience, bringing a unique set of skills and a shared commitment to helping you navigate the complex world of taxes and finance.

I am a seasoned tax professionals, certified accountant, and financial advisors, with a deep understanding of tax regulations, financial planning, and investment strategies. I believe in continuous learning and staying up-to-date with the latest industry trends to provide you with the most accurate and current advice.

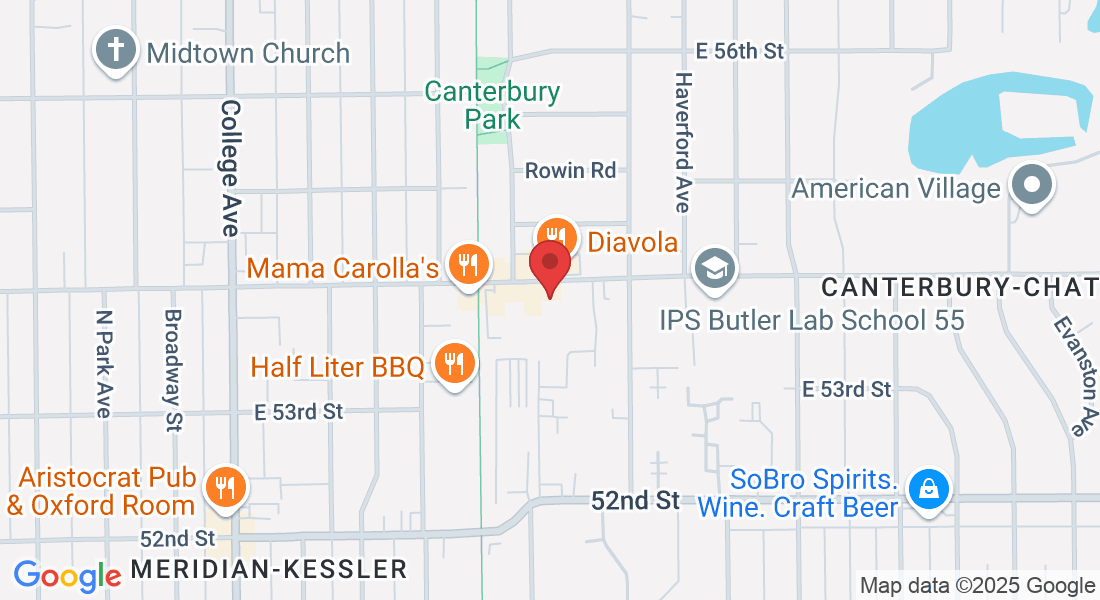

Get In Touch

Email: [email protected]

Address: 1111 E. 54th St, Suite 114, Indianapolis IN 46220

Operating Hours:

Mon – Fri 9:00am - 5:30pm

Sat/Sun – CLOSED

Email: [email protected]

Phone : (317) 374-7928

Address : 1111 E. 54th St, Suite 114, Indianapolis IN 46220